Start on a journey to learn the art of the Letter of Credit (LC), a pillar of international trade finance. This comprehensive book will enlighten you on the LC process, from its beginnings to its practical uses, allowing you to make educated judgments and ensure flawless worldwide transactions.

Explore the world of international trade and learn about a Letter of Credit (LC), a secure payment instrument that protects both exporters and importers. This thorough handbook will prepare you to handle the LC process with ease and confidence.

Introduction:

Letters of Credit (LC) serve as a pillar of security in the volatile world of international trade, bridging the gap between exporters and importers. This financial instrument, issued by a bank on behalf of an importer, serves as a guarantee of payment to the exporter upon presentation of particular documentation proving contract compliance.

What is a Letter of Credit (LC)?

A Letter of Credit is a contractual obligation by the buyer’s bank to pay the seller a defined sum of money upon presentation of specific documentation proving the shipment of goods or fulfillment of services. It serves as a payment guarantee, ensuring that the exporter receives the agreed-upon sum even if the buyer fails to pay.

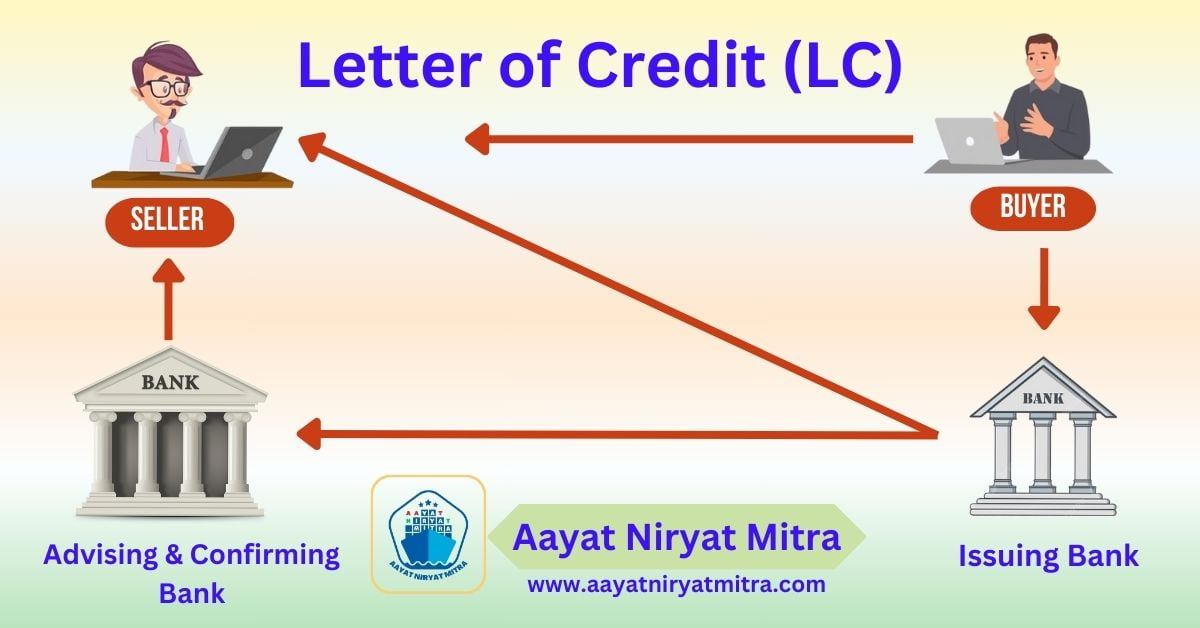

How does a Letter of Credit (LC) work?

The LC process involves several key steps:

- Application: The importer applies to their bank to open an LC in favor of the exporter.

- Issuance: The importer’s bank reviews the application and, if satisfactory, issues the LC, sending it to the exporter’s bank.

- Advising: The exporter’s bank receives the LC and notifies the exporter, ensuring they understand the terms and conditions.

- Shipment and Documentation: The exporter ships the goods and prepares the required documentation, such as a commercial invoice, packing list, and bill of lading.

- Presentation of Documents: The exporter presents the documentation to their bank for review and verification.

- Payment: Upon verifying the documents, the exporter’s bank sends them to the importer’s bank. If the documents comply with the LC terms, the importer’s bank releases payment to the exporter.

Advantages of Letter of Credit (LC)

LC offers several advantages for both exporters and importers:

For Exporters:

- Guaranteed Payment: Assures payment, reducing the risk of non-payment.

- Enhanced Cash Flow: Facilitates early payment, improving cash flow and financial stability.

- Mitigated Risk of Fraud: Reduces the risk of fraudulent transactions or disputes.

For Importers:

- Quality Assurance: Ensures the goods meet agreed-upon specifications through documentation requirements.

- Delivery Assurance: Guarantees timely delivery of goods through shipment documentation.

- Reduced Payment Risk: Eliminates the need to transfer funds directly to the exporter, lowering the risk of fraud.

Example of Letter of Credit (LC)

Step-by-step explanation of how an Indian exporter can sell toy items in Germany using a Letter of Credit (LC) as the payment term:

Step 1: Negotiation and Agreement

The Indian exporter and the German buyer agree on the terms of the sale, including the product specifications, quantity, price, and delivery terms. They also agree to use a Letter of Credit (LC) as the payment method.

Step 2: LC Application

The German buyer applies to their bank to issue an LC in favor of the Indian exporter. The LC application includes details about the buyer, the seller, the goods being sold, the payment terms, and the expiration date.

Step 3: LC Issuance

The buyer’s bank reviews the LC application and, if everything is in order, issues the LC. The LC is sent to the Indian exporter’s bank, which acts as the advising bank.

Step 4: LC Verification

The advising bank verifies the authenticity of the LC and notifies the Indian exporter that the LC has been issued. The exporter then reviews the LC to ensure that it complies with the terms of the sale agreement.

Step 5: Shipment and Documents Preparation

The Indian exporter ships the toy items to the German buyer. The exporter also prepares the following documents:

- Commercial invoice

- Packing list

- Bill of lading

- Certificate of origin

- Insurance certificate (if required)

Step 6: Documents Presentation

The Indian exporter presents the shipping documents to their bank. The bank reviews the documents and, if they are all in order, sends them to the buyer’s bank.

Step 7: LC Payment

The buyer’s bank verifies the shipping documents and, if they comply with the LC terms, pays the Indian exporter the agreed-upon price for the toy items.

Step 8: Goods Delivery

The German buyer receives the toy items and verifies that they are in accordance with the order.

Step 9: LC Discharge

The German buyer’s bank provides the Indian exporter with a copy of the LC payment confirmation, which serves as proof of payment. This discharges the LC and completes the transaction.

Benefits of Using LC

Using a Letter of Credit as the payment term offers several benefits for both the Indian exporter and the German buyer:

For the Indian exporter:

- Provides security of payment, as the buyer’s bank guarantees payment upon presentation of the required documents.

- Reduces the risk of non-payment, as the buyer cannot cancel the LC without the exporter’s consent.

- Improves cash flow, as the exporter receives payment upon shipment of the goods.

For the German buyer:

- Ensures that the goods are shipped and comply with the agreed-upon specifications.

- Eliminates the need to transfer funds directly to the exporter, reducing the risk of fraud.

- Protects against potential payment delays, as the LC guarantees timely payment to the exporter.

FAQs on Letter of Credit (LC):

-

Q: What is a Letter of Credit (LC)?

Ans: A Letter of Credit is a financial instrument issued by a bank at the request of the buyer (applicant) in favor of the seller (beneficiary), guaranteeing payment for goods or services once certain conditions are met.

-

Q: What are the types of Letter of Credit?

Ans: There are various types of LCs, including:

1. Revocable LC: Can be canceled or amended by the issuing bank without the exporter’s consent.

2. Irrevocable LC: Cannot be canceled or amended by the issuing bank without the consent of both the exporter and the importer.

3. Confirmed LC: The exporter’s bank guarantees payment, providing an additional layer of security.

4. Sight LC: Payment is made immediately upon presentation of compliant documents.

5. Usance LC: Payment is made at a predetermined future date. -

Q: What are the costs associated with a Letter of Credit?

Ans: The costs of an LC vary depending on the issuing bank, the type of LC, and the transaction value. They typically include a commission fee, document fees, and interest charges for usance LCs.

-

Q: What are the key considerations for using a Letter of Credit?

Ans: Carefully review the LC terms and conditions to ensure they align with the sales contract.

* Ensure accurate and timely presentation of required documentation.

* Communicate effectively with your bank throughout the LC process.

* Understand the implications of different LC types and choose the one that best suits your needs. -

Q: What is the difference between a Revocable and Irrevocable LC?

Ans: A Revocable LC can be modified or canceled by the issuing bank without notice to the beneficiary. An Irrevocable LC, on the other hand, cannot be changed or canceled without the consent of all parties involved.

-

Q: What documents are required for LC transactions?

Ans: Common documents include the commercial invoice, bill of lading, packing list, certificate of origin, and any other documents specified in the LC.

-

Q: How long does it take to process an LC transaction?

Ans: The time frame can vary, but it generally takes a few days to a few weeks for an LC transaction to be completed, depending on the complexity and accuracy of the documents.

-

Q: Can an LC be transferred to another party?

Ans: Yes, a Transferable LC allows the original beneficiary to transfer all or part of the credit to another party (second beneficiary).

-

Q: What is the role of the advising bank?

Ans: The advising bank, often located in the seller’s country, is responsible for authenticating and delivering the LC to the beneficiary.

-

Q: Can an LC be amended?

Ans: Yes, an LC can be amended if all parties involved agree to the changes. Amendments are typically made to correct errors or accommodate changes in the transaction.

-

Q: How does an LC work?

Ans: The buyer and seller agree to use an LC as the method of payment. The buyer’s bank issues the LC, and the seller ensures that the terms and conditions of the LC are met before presenting documents to receive payment.

-

Q: What is the ‘UCP 600’?

Ans: The Uniform Customs and Practice for Documentary Credits (UCP 600) is a set of international rules published by the International Chamber of Commerce (ICC) that govern the use of Letters of Credit.

Conclusion:

Letters of Credit are a key component of international trade financing, serving as a safe and dependable mechanism for settling cross-border transactions. Its ability to protect exporters from payment risks while also protecting importers from quality and delivery concerns makes it an invaluable tool in facilitating trade.

If you discover an error in the “Letter of Credit (LC): A Comprehensive Guide 2024” information provided to us, please notify us immediately via the comment box and email; if the information provided by you is correct, We will change it.

If you enjoyed this article, please share it with your friends. Please visit Aayat Niryat Mitra | Import Export Friend for more information on this and other topics. Thank you for stopping by.

6 thoughts on “Letter of Credit (LC): A Comprehensive Guide 2024”